Income Tax and GST updates

Income Tax updates-

1. Income Tax FY 18-19 Last Date 30 June 2020. Interest @9%p.a.

2. No extension in TDS payments for FY 19-20. Only interest @9%p.a, for payments upto 30 June 20.

3. Aadhar PAN linking extended to 30 June 20.

4. Vivad se Vishwas Scheme extended to 30 June 20, without additional 10%.

5. Due dates for all compliances, and furnishing of returns and reports, including investment in 80C, extended to 30 June 20.

Income Tax and GST updates see more

GST CHANGES-

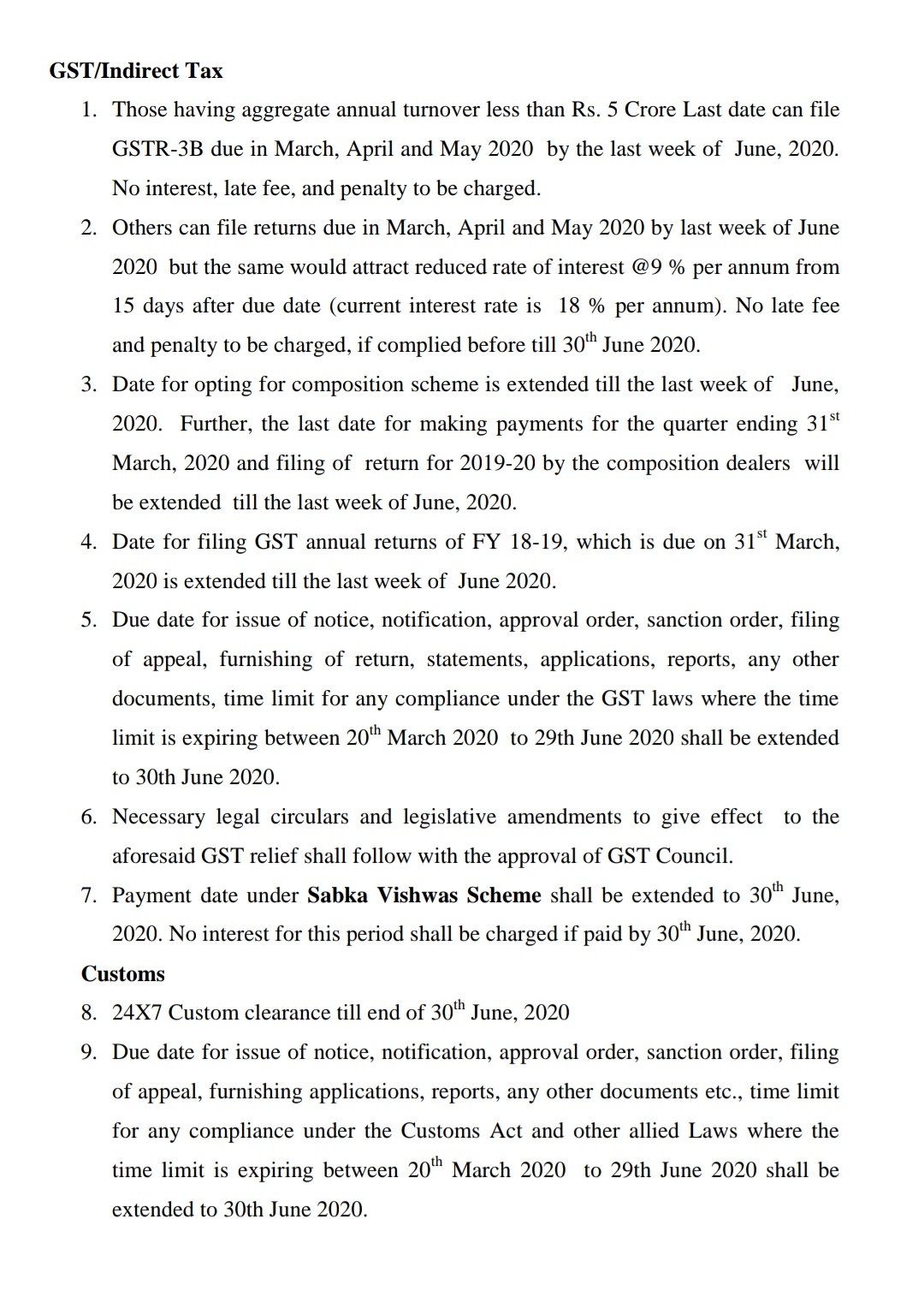

1. Last date for Mar-Apr 20 returns, including Composition will be 30 June 20.

2. Companies < Rs 5 Crore turnover, will not be charged any interest and late fees.

3. Companies > Rs 5 Crore turnover, will be charged interey@9% p.a., that too after 15 days.

4. Opting for Composition, can be done till 30 June 20, depending on states.

Announcement by Finance Minister Today on Income Tax and GST updates

*1. For FY 2018-19-Last Date To File ITR Extended to 30-06-2020, Interest rate on delayed Payment Reduced to 9% from 12%

2. On Delayed Deposit of TDS Interest Reduced to 9%

3. Adhaar and Pan Card Linking Extended to 30th June 2020

4. Scheme of Vivad sai Vishvas Extended to 30th June 2020.

5. Investment for Deduction under 80C Also Extended to 30-06-2020

6. GST Last Date For filing GST Returns for Mar, Apr and May 2020 is extended to 30-06-2020

7. Companies having turnover Less than 5Cr – No Interest, No Late Fee, No Penalty.

8. Under GST Date for opting for Composition Scheme is also Extended to 30-06-2020.

9. Custom and Excise Scheme Sabka Vishvas is further extended to 30-06-2020

10. Custom Clearance will operate 24X7 upto 30th June 2020

11. MCA21 RELATED- Moratorium issued upto 30-06-2020. There will be no additional fees for filling of various Forms. Relaxing Board Meeting by 60 Days for Next 2 Quarters.

12. CARO New Order now applicable From FY 2020-21.

13. For Newly Incorporated Companies- Filling of Commencement of Business intimation was to be done within 6 Month is further extended by 6 Month.

14. Every Company Required to Create a Deposit Reserve of 20% of the deposits maturing within Next 1yrs by 30-04-2020. This deadline extended to 30-06-2020. Similar requirement was there for Debenture maturing. It is also extended to 30-06-2020.

15. IBC Basic Limit of 1 Lac Increased to 1Cr for filing of CA .

see and click for more updates FM TWITTER

Ministry of Finance@FinMinIndia·